Page 102 - One Report Thai Final_ENG_2021

P. 102

Tycoons Worldwide Group (Thailand) Plc.

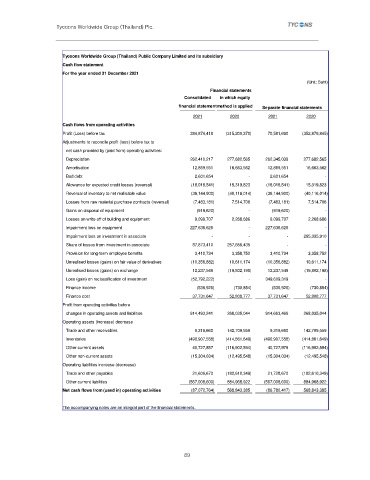

Tycoons Worldwide Group (Thailand) Public Company Limited and its subsidiary

Cash flow statement

For the year ended 31 December 2021

(Unit: Baht)

Financial statements

Consolidated in which equity

financial statementmethod is applied Separate financial statements

2021 2020 2021 2020

Cash flows from operating activities

Profit (Loss) before tax 384,874,418 (315,200,370) 70,581,690 (352,879,845)

Adjustments to reconcile profit (loss) before tax to

net cash provided by (paid from) operating activities:

Depreciation 262,410,217 277,682,565 262,345,039 277,682,565

Amortisation 12,869,551 16,663,562 12,869,551 16,663,562

Bad debt 2,601,654 - 2,601,654 -

Allowance for expected credit losses (reversal) (18,018,541) 15,319,823 (18,018,541) 15,319,823

Reversal of inventory to net realisable value (36,144,900) (40,116,014) (36,144,900) (40,116,014)

Losses from raw material purchase contracts (reversal) (7,483,181) 7,514,706 (7,483,181) 7,514,706

Gains on disposal of equipment (919,620) - (919,620) -

Losses on write-off of building and equipment 9,099,707 2,268,686 9,099,707 2,268,686

Impairment loss on equipment 227,636,626 - 227,636,626 -

Impairment loss on investment in associate - - - 295,335,910

Share of losses from investment in associate 87,873,410 257,656,435 - -

Provision for long-term employee benefits 3,410,734 3,358,752 3,410,734 3,358,752

Unrealised losses (gains) on fair value of derivatives (10,356,882) 10,611,174 (10,356,882) 10,611,174

Unrealised losses (gains) on exchange 12,237,549 (19,802,198) 12,237,549 (19,802,198)

Loss (gain) on reclassification of investment (52,792,222) - 349,609,319 -

Finance income (536,926) (730,854) (536,926) (730,854)

Finance cost 37,731,647 52,808,777 37,731,647 52,808,777

Profit from operating activities before

changes in operating assets and liabilities 914,493,241 268,035,044 914,663,466 268,035,044

Operating assets (increase) decrease

Trade and other receivables 9,319,660 142,709,559 9,319,660 142,709,559

Inventories (490,907,558) (414,861,649) (490,907,558) (414,861,649)

Other current assets 40,727,857 (116,902,594) 40,727,979 (116,902,594)

Other non-current assets (15,304,034) (12,495,548) (15,304,034) (12,495,548)

Operating liabilities increase (decrease)

Trade and other payables 21,606,670 (182,610,349) 21,728,670 (182,610,349)

Other current liabilities (567,008,600) 884,968,922 (567,008,600) 884,968,922

Net cash flows from (used in) operating activities (87,072,764) 568,843,385 (86,780,417) 568,843,385

The accompanying notes are an integral part of the financial statements.

89