Page 149 - TYCONS - ANNUAL REPORT 2022

P. 149

Tycoons Worldwide Group (Thailand) Plc.

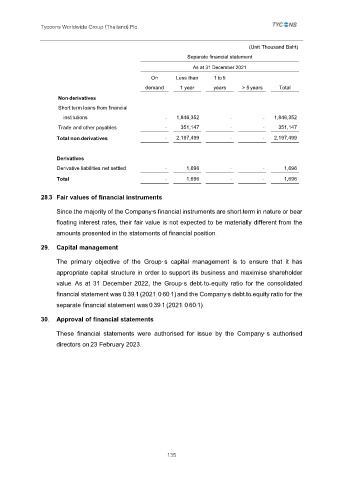

(Unit: Thousand Baht)

Separate financial statement

As at 31 December 2021

On Less than 1 to 5

demand 1 year years > 5 years Total

Non-derivatives

Short-term loans from financial

institutions - 1,846,352 - - 1,846,352

Trade and other payables - 351,147 - - 351,147

Total non-derivatives - 2,197,499 - - 2,197,499

Derivatives

Derivative liabilities: net settled - 1,696 - - 1,696

Total - 1,696 - - 1,696

28.3 Fair values of financial instruments

Since the majority of the Company’s financial instruments are short-term in nature or bear

floating interest rates, their fair value is not expected to be materially different from the

amounts presented in the statements of financial position.

29. Capital management

The primary objective of the Group’ s capital management is to ensure that it has

appropriate capital structure in order to support its business and maximise shareholder

value. As at 31 December 2022, the Group’s debt-to-equity ratio for the consolidated

financial statement was 0.39:1 (2021: 0.60:1) and the Company’s debt-to-equity ratio for the

separate financial statement was 0.39:1 (2021: 0.60:1).

30. Approval of financial statements

These financial statements were authorised for issue by the Company’ s authorised

directors on 23 February 2023.

135