Page 146 - TYCONS - ANNUAL REPORT 2022

P. 146

Tycoons Worldwide Group (Thailand) Plc.

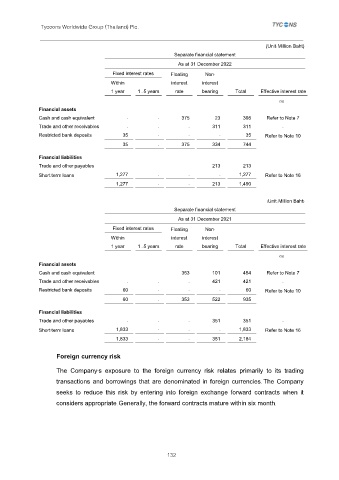

(Unit: Million Baht)

Separate financial statement

As at 31 December 2022

Fixed interest rates Floating Non-

Within interest interest

1 year 1 - 5 years rate bearing Total Effective interest rate

(%)

Financial assets

Cash and cash equivalent - - 375 23 398 Refer to Note 7

Trade and other receivables - - - 311 311 -

Restricted bank deposits 35 - - - 35 Refer to Note 10

35 - 375 334 744

Financial liabilities

Trade and other payables - - - 213 213 -

Short-term loans 1,277 - - - 1,277 Refer to Note 16

1,277 - - 213 1,490

(Unit: Million Baht)

Separate financial statement

As at 31 December 2021

Fixed interest rates Floating Non-

Within interest interest

1 year 1 - 5 years rate bearing Total Effective interest rate

(%)

Financial assets

Cash and cash equivalent - - 353 101 454 Refer to Note 7

Trade and other receivables - - - 421 421 -

Restricted bank deposits 60 - - - 60 Refer to Note 10

60 - 353 522 935

Financial liabilities

Trade and other payables - - - 351 351 -

Short-term loans 1,833 - - - 1,833 Refer to Note 16

1,833 - - 351 2,184

Foreign currency risk

The Company’s exposure to the foreign currency risk relates primarily to its trading

transactions and borrowings that are denominated in foreign currencies. The Company

seeks to reduce this risk by entering into foreign exchange forward contracts when it

considers appropriate. Generally, the forward contracts mature within six month.

132