Page 128 - One Report Thai Final_ENG_2021

P. 128

Tycoons Worldwide Group (Thailand) Plc.

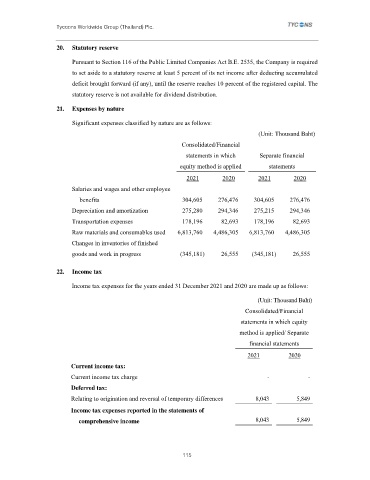

20. Statutory reserve

Pursuant to Section 116 of the Public Limited Companies Act B.E. 2535, the Company is required

to set aside to a statutory reserve at least 5 percent of its net income after deducting accumulated

deficit brought forward (if any), until the reserve reaches 10 percent of the registered capital. The

statutory reserve is not available for dividend distribution.

21. Expenses by nature

Significant expenses classified by nature are as follows:

(Unit: Thousand Baht)

Consolidated/Financial

statements in which Separate financial

equity method is applied statements

2021 2020 2021 2020

Salaries and wages and other employee

benefits 304,605 276,476 304,605 276,476

Depreciation and amortization 275,280 294,346 275,215 294,346

Transportation expenses 178,196 82,693 178,196 82,693

Raw materials and consumables used 6,813,760 4,486,305 6,813,760 4,486,305

Changes in inventories of finished

goods and work in progress (345,181) 26,555 (345,181) 26,555

22. Income tax

Income tax expenses for the years ended 31 December 2021 and 2020 are made up as follows:

(Unit: Thousand Baht)

Consolidated/Financial

statements in which equity

method is applied/ Separate

financial statements

2021 2020

Current income tax:

Current income tax charge - -

Deferred tax:

Relating to origination and reversal of temporary differences 8,043 5,849

Income tax expenses reported in the statements of

comprehensive income 8,043 5,849

115