Page 138 - TYCONS - ANNUAL REPORT 2022

P. 138

Tycoons Worldwide Group (Thailand) Plc.

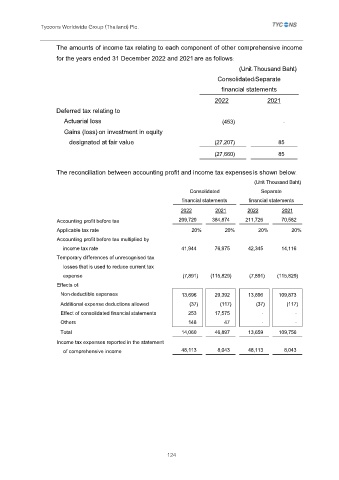

The amounts of income tax relating to each component of other comprehensive income

for the years ended 31 December 2022 and 2021 are as follows:

(Unit: Thousand Baht)

Consolidated/Separate

financial statements

2022 2021

Deferred tax relating to

Actuarial loss (453) -

Gains (loss) on investment in equity

designated at fair value (27,207) 85

(27,660) 85

The reconciliation between accounting profit and income tax expenses is shown below.

(Unit: Thousand Baht)

Consolidated Separate

financial statements financial statements

2022 2021 2022 2021

Accounting profit before tax 209,720 384,874 211,726 70,582

Applicable tax rate 20% 20% 20% 20%

Accounting profit before tax multiplied by

income tax rate 41,944 76,975 42,345 14,116

Temporary differences of unrecognised tax

losses that is used to reduce current tax

expense (7,891) (115,829) (7,891) (115,829)

Effects of:

Non-deductible expenses 13,696 29,392 13,696 109,873

Additional expense deductions allowed (37) (117) (37) (117)

Effect of consolidated financial statements 253 17,575 - -

Others 148 47 - -

Total 14,060 46,897 13,659 109,756

Income tax expenses reported in the statement

of comprehensive income 48,113 8,043 48,113 8,043

124