Page 143 - TYCONS - ANNUAL REPORT 2022

P. 143

Tycoons Worldwide Group (Thailand) Plc.

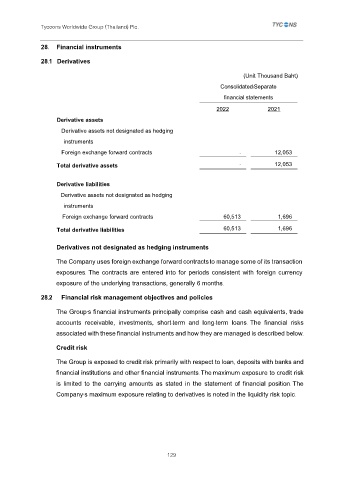

28. Financial instruments

28.1 Derivatives

(Unit: Thousand Baht)

Consolidated/Separate

financial statements

2022 2021

Derivative assets

Derivative assets not designated as hedging

instruments

Foreign exchange forward contracts - 12,053

Total derivative assets - 12,053

Derivative liabilities

Derivative assets not designated as hedging

instruments

Foreign exchange forward contracts 60,513 1,696

Total derivative liabilities 60,513 1,696

Derivatives not designated as hedging instruments

The Company uses foreign exchange forward contracts to manage some of its transaction

exposures. The contracts are entered into for periods consistent with foreign currency

exposure of the underlying transactions, generally 6 months.

28.2 Financial risk management objectives and policies

The Group’s financial instruments principally comprise cash and cash equivalents, trade

accounts receivable, investments, short-term and long-term loans. The financial risks

associated with these financial instruments and how they are managed is described below.

Credit risk

The Group is exposed to credit risk primarily with respect to loan, deposits with banks and

financial institutions and other financial instruments. The maximum exposure to credit risk

is limited to the carrying amounts as stated in the statement of financial position. The

Company’s maximum exposure relating to derivatives is noted in the liquidity risk topic.

129